The Hidden Cost of “IRS-Approved” (like Cash Balance Plans)Tax Strategies for Business Owners

I’m going to upset some people with this article—and that’s fine by me.

Because if you’re a business owner making $300K, $700K, or $1M+ per year, you deserve the truth about what’s actually happening in the financial marketplace. Not fluff. Not buzzwords. And definitely not strategies that only make sense on a whiteboard.

I recently got an email promoting an “IRS-approved” tax strategy. It hit all the usual notes:

- Keep more of what you earn

- Reduce your tax bill

- Create a tax shelter for up to $400,000 per year

- Pay yourself instead of Uncle Sam

Sounds good, right?

But what they didn’t say could cost you millions.

The Buzzwords Business Owners Fall For

This kind of language shows up in nearly every pitch to high-income earners. It’s clean. It’s credible. It’s familiar.

And that’s exactly the problem.

Once you know the language, you start to see behind the curtain:

- “IRS-approved” — There is no IRS-approved checklist. There is a tax code. There is case law. And there is the question: can you defend this in an audit?

- “Keep more of what you earn” — Nice slogan. But are we talking about cash in hand now, or future tax obligations kicking the can down the road?

- “The tax reduction strategy no one told you about” — That scarcity play? It usually means they’re pitching a cash balance plan or defined benefit plan—tools that have been around for decades.

- “Pay yourself instead of Uncle Sam” — You’re not avoiding taxes. You’re deferring them.

These phrases aren’t inherently wrong. But they’re so overused and so oversold that they hide more than they reveal.

What They’re Actually Selling: The Cash Balance Plan

This email was promoting a cash balance plan—a defined benefit retirement plan that lets high-income earners contribute large sums and defer taxes until retirement.

Technically, everything they said in the email could be true:

- Yes, it’s in the tax code

- Yes, contributions are deductible

- Yes, you can contribute up to $400K/year… if you’re 70 and meet strict criteria

But let’s put it through the owner-investor lens:

Does this help you keep more cash flow today?

Does it create optionality in the future?

Does it multiply wealth?

Or does it just look good?

The Math Behind the Hype (And What the Numbers Really Say)

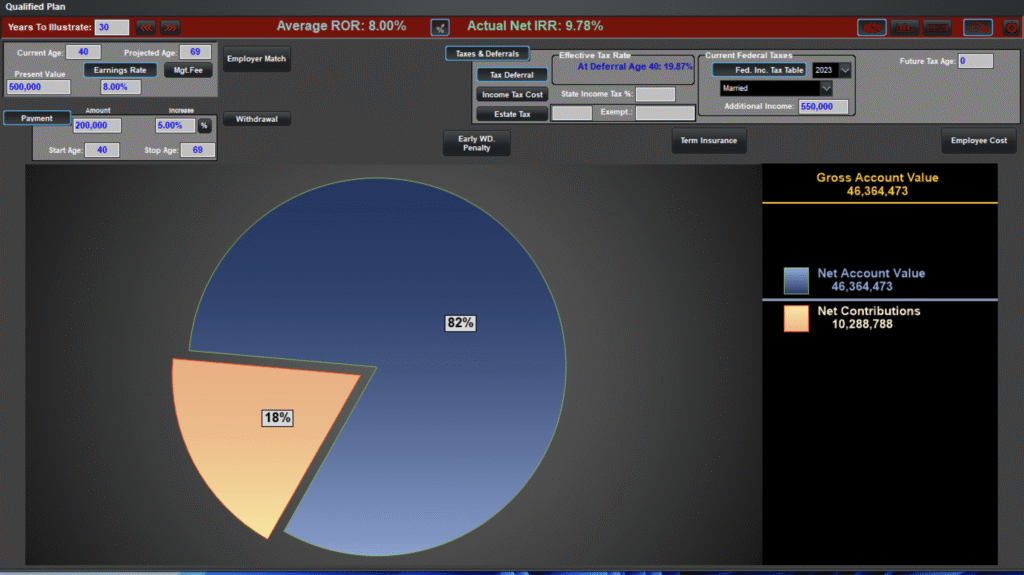

You’re 40 years old. You commit to contributing $200,000 per year into a cash balance plan. That amount increases by 5% annually. The plan assumes an 8% earnings rate over the next 30 years.

By the time you hit age 70, your gross account value is projected to be $46.36 million.

That’s what shows up in the pitch deck—the big pie chart. The one that feels like wealth. And on paper, it looks like a win:

- Total Net Contributions: $10.29 million

- Projected Gross Value: $46.36 million

- Actual Net IRR: 9.78%

And the pie chart shows it visually: 82% of the value is growth, and only 18% is what you actually contributed. That feels like compounding magic.

But here’s the issue—this is where most advisors stop the story. This is where the email was leading us.

They show you the IRR.

They show you the gross total.

They make the chart big and bold.

And they leave out everything else.

The Fees That Eat Your Future

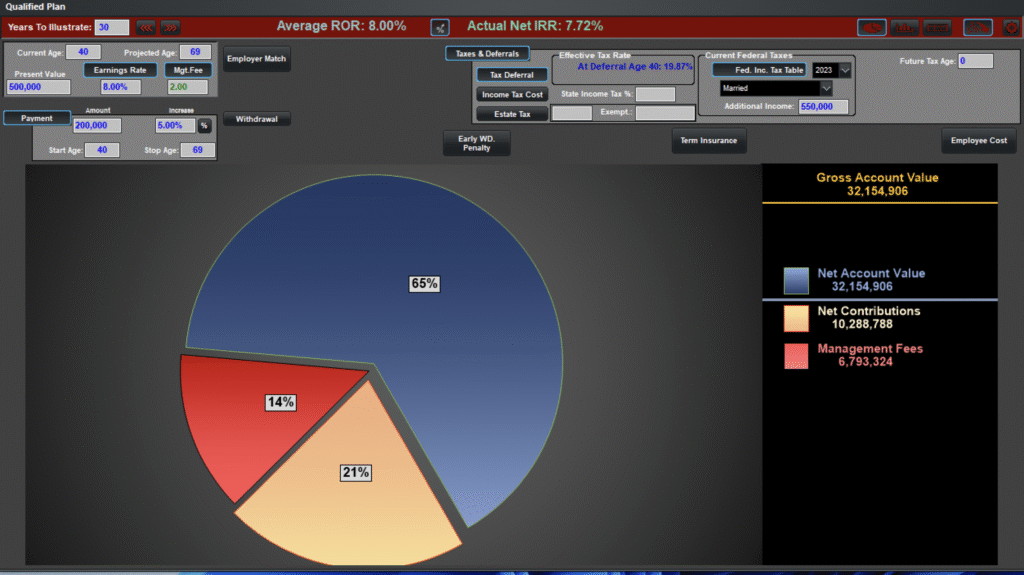

Take a look at what happens when we include just the 2% annual fee over those same 30 years.

Your total contributions are the same:

$10,288,788

But now look at the new breakdown:

- Gross Account Value: $32,154,906

- Management Fees Paid: $6,793,324

- Net IRR: 7.72%

Visually, it hits even harder.

That bold red wedge in the pie chart? That’s nearly $7 million in value gone—just to fees.

You gave $10M of your hard-earned profit to this plan…

And lost 65% of the growth to overhead.

Let that sink in:

14% of your total “retirement” is now lining someone else’s pockets.

That’s not tax strategy.

That’s a quiet transfer of wealth—from your future to their fees.

And we still haven’t talked about taxes yet.

The Tax Time Bomb: The Other Half of the Story They Don’t Tell

Let’s say you’ve gotten past the glossy projections and swallowed the fee story.

Now it’s time for the final truth: taxes.

Here’s where most business owners get misled, often in two ways:

First, they believe they’ve saved taxes.

Reality? You didn’t save anything—you deferred them.

Every dollar you “saved” is still owed to the IRS. You just kicked the can 30 years down the road. It’s not a win. It’s a delay.

Second, they assume this tax strategy creates more cash flow today.

Also false. That tax savings doesn’t land in your bank account.

It gets locked inside the plan—completely untouchable until retirement.

So while you’re funding this strategy, your lifestyle doesn’t improve. Your monthly freedom doesn’t increase.

You feel broke now… and still owe taxes later.

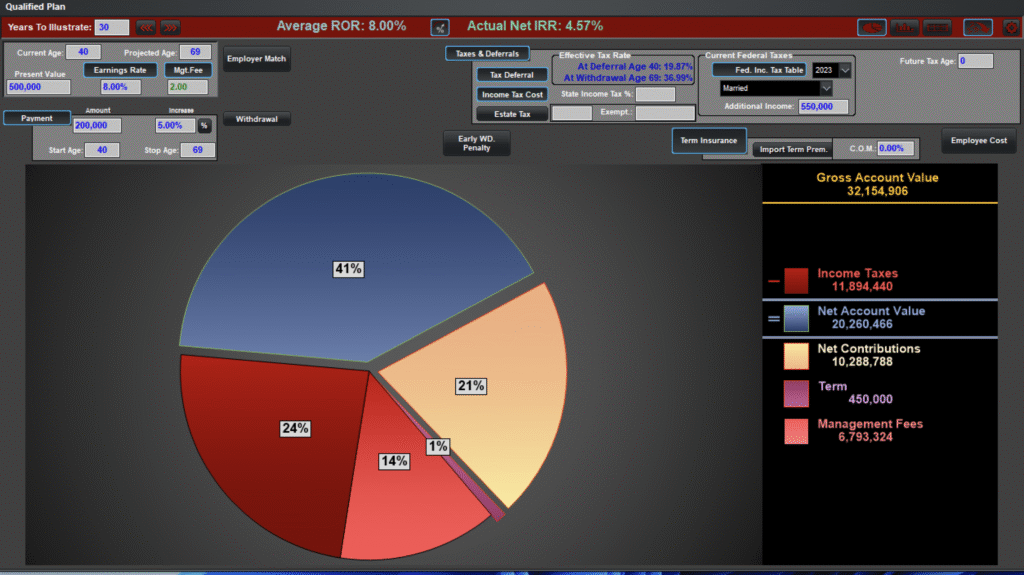

Let’s look at what happens when we apply the real tax math.

From your prior chart, we saw the gross account value after fees land at $32.15 million.

Now, we factor in a retirement tax rate of 37%—which is realistic for high earners in the future.

- Taxes Owed: $11.89 million

- Net Account Value: $20.26 million

- Final IRR: 4.57%

Visually? The pie chart tells the story:

- 24% of your “retirement account” vanishes to taxes

- 14% has already gone to fees

- Only 41% is actually yours

You contributed $10.29M to this plan.

You waited 30 years.

You ended up with a net of $20.26M.

That’s not 2x your money.

That’s 1.97x over three decades—after losing a third of the gains to things you didn’t control.

Bottom Line:

You didn’t save taxes.

You didn’t increase cash flow.

You didn’t gain liquidity.

What you got was:

- Locked-up capital

- Deferred obligations

- And a 4.57% return with massive restrictions

That might be fine for someone with no better options.

But for a business owner with profit, opportunity, and vision?

It’s likely you can do better.

What Most Business Owners Think They’re Getting… vs. What They Actually Get

Here’s what the marketing tells you:

“You’ll have more money, more freedom, and lower taxes.”

Here’s what the math actually says—especially if your cash balance plan ends up invested in life insurance, annuities, or low-growth, low-volatility instruments (as many are).

Now we’re looking at a 5% earnings rate—still generous for most insurance-heavy portfolios.

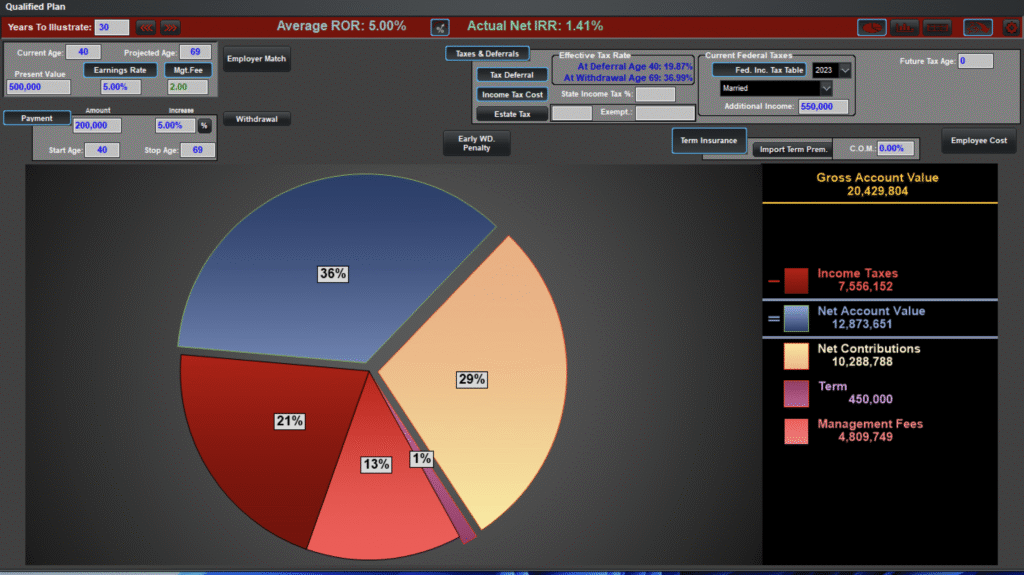

From the chart you see:

- Gross Account Value: $20.4M

- Net Contributions: $10.29M

- Income Taxes Due: $7.56M

- Management Fees Paid: $4.81M

- Term Insurance Drag: $450K

- Final Net Account Value: $12.87M

- Final IRR: 1.41%

Let’s be real.

Would you tie up $10M in capital for 30 years, for a final return of 1.41%?

That’s not freedom.

That’s not strategy.

That’s not wealth-building.

That’s a glorified savings account with restrictions, fees, and tax exposure at the finish line.

Worse, 64% of your account’s potential is lost to three things:

- Taxes you thought you saved

- Fees no one disclosed up front

- Insurance products you didn’t even realize were embedded

And you’re left with only 36% of the pie.

This is why so many business owners hit their 60s asking the same question:

“Where did all the wealth go?”

It wasn’t spent.

It wasn’t wasted.

It was just never structured correctly to begin with.

So Why Are These Still Sold?

Because they’re easy.

They draw you in with the promise of “tax savings,” and because you know you should be doing something for retirement, you let the tax tail wag the wealth dog.

They create recurring revenue for advisors—AUM fees, commissions, insurance overrides.

And most importantly: they’re not inherently bad.

But they’re often completely misaligned with the life and vision of an entrepreneur.

If you’re building big things… you need a big framework.

Who Might Benefit from a Cash Balance Plan?

This tool can work for a very specific type of person:

- Someone without a family office structure

- Someone who wants “safe” outcomes, not maximum ones

- Someone who prefers to outsource responsibility rather than lead their wealth strategy

- Someone who’s okay with “hitting something” rather than optimizing everything

It’s not wrong.

It’s just not aligned with owners who want full financial agency and real freedom.

A Better Path: Build a Family Office Mindset

You don’t need another trick.

You need a framework.

That framework is the family office model.

And no—it’s not just for the ultra-wealthy.

It’s for those who want to think like the ultra-wealthy.

A real family office:

- Integrates business, tax, legal, and investment strategy

- Builds toward reinvestment, legacy, and liquidity

- Avoids silos, conflict, and one-dimensional “advice”

- Focuses on control and compounding, not complexity

If you’re still using W-2 playbooks to run an 8-figure business, it’s time to upgrade your lens.

What We Do at Big Life Financial

At Big Life, we don’t just sell products.

We build systems.

We help growth-stage business owners design a modern family office built around their biggest unfair advantage: their business.

We help you:

- Multiply income into long-term wealth

- Save taxes—not just defer them

- Build both liquidity and legacy

- Use the business as the core asset, not the funding source

And this is key:

Deferral isn’t evil. We use it too.

But the way deferral is framed in the industry is where the harm begins.

You’re told you’re “saving” taxes—when in reality, you’re just postponing them.

And if you don’t have a system to turn that deferral into opportunity?

You’ve just delayed your problem.

Final Thought: Ask Better Questions

You don’t need more “options.”

You need better filters.

Next time a tax strategy hits your inbox, ask:

- Does this increase my cash flow today?

- Will it create liquidity later?

- Does it give me control over my capital?

- Most importantly: Does it align with my vision?

Will doing this actually get me to where I want to go?

If the answer is no—it’s not the move.

Ready to Build a Real Wealth System?

Don’t let a polished email or a one-size-fits-all plan distract you from what actually works.

Let’s design, build, and lead your family office—starting with the one asset almost every other strategy ignores:

The business that got you here.