Table of Contents

If you want to know how to increase business valuation, stop optimizing for busy and start optimizing for predictability. Operators chase organic growth and hope the stars align. Owner-investors design growth, de-risk it, and make the future cash flows so believable that buyers raise the multiple on their own.

This is the playbook I teach clients who are done trading hours for dollars and ready to build an asset buyers compete to own. It is simple, practical, and measurable. You will see exactly how to grow profit credibly, widen your multiple, and turn your business into a wealth engine that outlives you.

The shift that changes the math

Owner-operators ask, “How do I sell more this month?”

Owner-investors ask, “How do I make next year’s profit larger and more certain than this year’s?”

Valuation responds to that second question. Buyers pay for predictable earnings and believable growth. If your profit line is consistent and the future looks de-risked, the multiple moves. The work, then, is two levers in concert:

- Grow profit with credibility.

- Lower perceived risk so the market rewards you with a higher multiple.

Everything below serves those two levers.

First principles: two numbers you must see every week

- Wealth Gap. Target net worth versus the sum of your income streams and assets. This shows the hole you must fill.

- Valuation Gap. What your business is worth today versus what it must be worth for you to hit the wealth target on time.

When you see both gaps in black and white, the next moves stop being random. You stop “trying things” and start underwriting a plan.

Where growth really comes from: four doors, not fifty

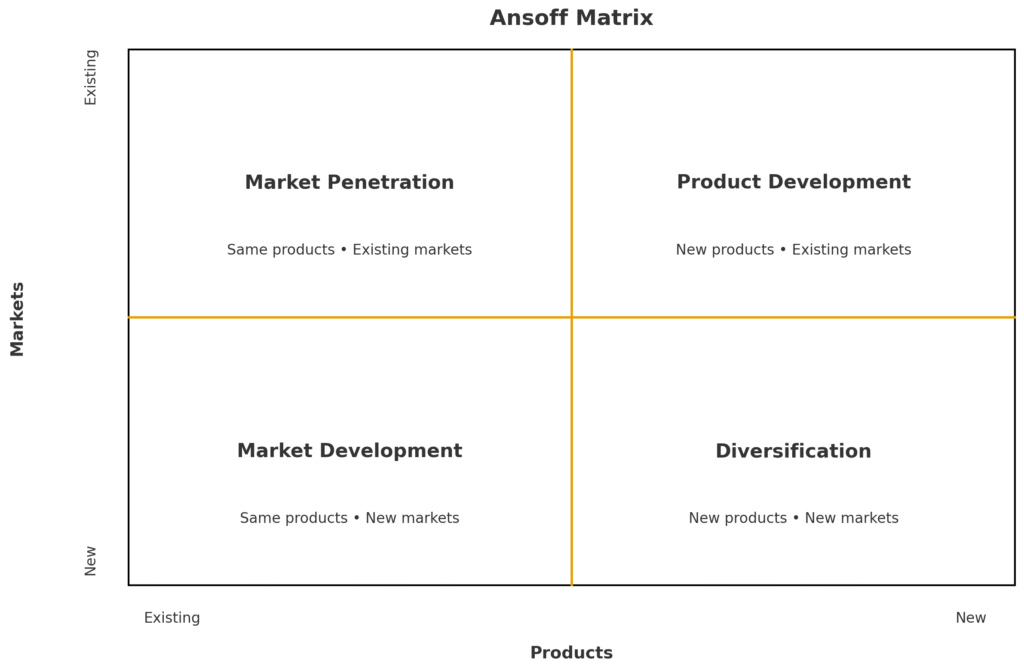

When owners stall, it is rarely because there is no growth left. It is because they have only pulled one lever. Use the Ansoff map to choose deliberately.

Door 1: Same products to the same market.

Low risk, fastest to cash. Lift conversion rates. Increase average ticket size. Capture more of the inbound you already get. Steal share by improving offer, speed, convenience, or trust.

Door 2: Same products to new markets.

Geographic expansion. New segments like fleet, commercial, or adjacent niches that mirror your buyer but in a different lane. This is how you pour fuel once Door 1 hits natural limits.

Door 3: New products to existing customers.

Add services your current buyers already need before, during, or after the core purchase. Think bundles, maintenance plans, subscriptions, or specialized add-ons. Margin often improves here.

Door 4: New products to new markets.

Diversification. Use it when you have a repeatable engine in the core and a clear reason to expand. Highest risk, potentially highest upside, never the first move.

Owner-investors push Door 1 hard, then open Door 2 and Door 3 to compound. Door 4 comes last and only with a thesis, not curiosity.

De-risk the pond before you jump

It is not enough to have an idea. You need to know the market will give your dollars back with friends. A quick five-factor scan saves expensive mistakes:

- Rivalry. How many credible competitors and how aggressive are they.

- New Entrants. How easy is it for a new player to copy your model and undercut you.

- Supplier Power. Can vendors squeeze your margins or disrupt availability.

- Customer Power. How price sensitive and how easy is it for buyers to switch.

- Substitutes. What else solves the same problem.

If rivalry is intense and entry is easy, growth will demand heavy marketing just to stand still. That may be fine, but it must be priced into your plan. Owner-investors face those facts up front and pick their battles accordingly.

Not all revenue is created equal: segment to get paid more

When buyers look at your P&L, they do not see “revenue.” They see a mix of revenue. Some lines are high-quality cash flow. Some drag. Your job is to tilt the mix.

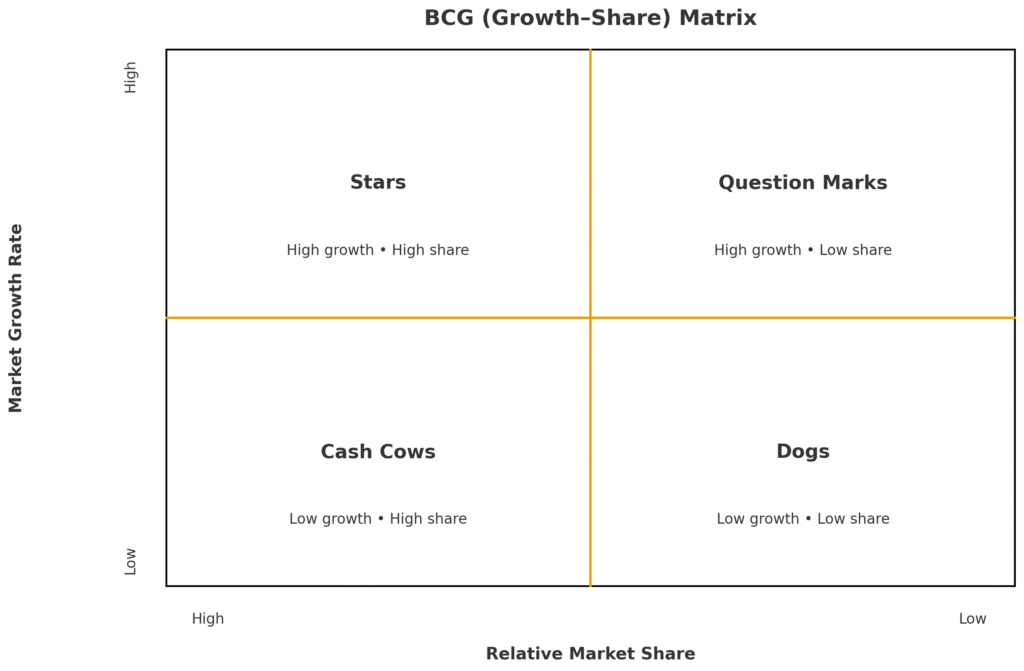

Use a simple matrix:

- Stars: High growth, high share. Feed these.

- Cash Cows: High cash, slower growth. Milk these to fund what is next.

- Question Marks: Promising but unproven. Test quickly. Either scale or stop.

- Dogs: Low growth, low share. Cut unless they enable a profitable bundle.

Two practical notes:

- Some apparent “dogs” exist to sell the “drink.” Think of low-margin items that reliably lead to high-margin purchases. Price and package the bundle, not the item.

- If you intentionally price a door-opener low to acquire clients, treat that as marketing, not product. Measure lifetime value against it and be ruthless if it does not pay.

Choose the right vehicle: organic, partnership, or acquisition

The what is only half of growth. The how matters just as much. Pick the right vehicle for each initiative.

Organic.

Best for control and margins when time and capability are on your side. Use it to deepen Door 1 and Door 3 moves, especially where your operating standards create advantage.

Alliances and Joint Ventures.

Open distribution or capabilities faster than you could build alone. Requires tight governance, clear roles, and an exit plan. Great for Door 2 expansion and certain Door 3 additions.

Acquisitions.

Compress time when you have a repeatable integration playbook. The thesis should be obvious in one sentence: “We buy X, plug in Y platform, and unlock Z.” The wrong deal with a fuzzy plan is how owners learn the hard way. The right deal with a crisp plan turns a five-year road into a two-year sprint.

ACE: the cadence that turns strategy into valuation

Analysis.

See reality. What works today. Where you win deals and where you lose them. Price benchmarks. Capacity limits. Demand patterns by zip code, segment, and season. Pull one or two cross-industry ideas you can prove in your world. You do not need a 60-page deck. You need truth you can act on.

Capital.

Fund the few moves that matter. Sequence spend. Do not starve your cows to feed a question mark. Decide in advance what “success” means for each initiative and how long you will give it before you double down or cut.

Execution.

Monthly review of the vital few. No vanity metrics. Tie every line item to one of the two valuation levers: higher profit or lower risk. If an activity cannot explain which lever it moves, it does not get budget.

Make your budget read like an investor memo

Most budgets are wish lists. Owner-investors write underwriting statements. Here is the format:

- Target: Increase profit by 800,000 in the next 12 months.

- Source of lift:

- 40 percent from Door 1: conversion lift, ticket size, capture more inbound.

- 20 percent from Door 2: add one geography with a cloned offer and proven ads.

- 25 percent from Door 3: launch a membership or maintenance plan with an existing base.

- 15 percent from a bolt-on acquisition with defined integration milestones.

- Funding plan: Working capital for Doors 1 and 3, shared-risk partnership for Door 2, small seller-financed bolt-on for acquisition.

- Milestones and gates: Clear dates, leading indicators, and a kill switch if the data misses two checkpoints in a row.

- Accounting optics: Capitalize where appropriate so year-one EBITDA supports your multiple target without disguising reality.

When you can explain the lift, the funding, and the gates in this way, you are thinking like a buyer before the buyer arrives.

Culture and experience are valuation assets

You will not out-discount your way to a premium multiple. You can, however, design an experience that is hard to copy and easy to feel. Think about coffee before the modern café experience. The product did not change much. The experience did. The price point and loyalty followed.

Codify three delivery standards clients feel every time. Measure them. Teach to them. Reputation reduces risk in the buyer’s model. That moves the multiple.

Practical safeguards that keep money in your pocket

- Loss leaders are marketing. Book them that way and demand a provable payback.

- Do not “fatten the pig.” Firing key talent to inflate short-term profit is obvious to any buyer who has read a P&L. The adjustments will come out in diligence.

- Know the limits of cost cutting. Trim fat, yes. Cut muscle and bone, and your capability shrinks with your multiple.

- Bundle intentionally. Some lower-margin services exist to enable the sale that matters. Price the bundle so the unit economics make sense without heroics.

A 90-day sprint to raise credibility and lower risk

Week 1: Market scan and benchmarks.

List top competitors, public pricing, response times, and offers. Identify the easiest point to steal share in the next 30 days.

Week 2: Revenue segmentation.

Classify every product or service as Star, Cash Cow, Question Mark, or Dog. Draw a one-page map that shows which “dogs” sell the “drinks.” Reallocate 10 percent of marketing and ops time toward Stars and the highest-potential Question Mark.

Week 3: Two Ansoff bets.

Pick one Door 1 improvement and one Door 2 or Door 3 expansion. Write the micro-offer, the channel, the KPI that proves it, and the stop rule.

Week 4: Pick the vehicle.

Decide organic, alliance, JV, or acquisition for each bet. Draft the operating model on a single page: roles, SLAs, economics, and exit provisions.

Weeks 5-8: Prove the signal.

Run the Door 1 test to significance. Launch the Door 2 or Door 3 pilot in one contained geography or segment. Hold weekly check-ins against your leading indicators.

Weeks 9-12: Lock standards and scale.

Codify the delivery standards that protect the experience as you grow. Shift budget from “nice ideas” to the proven moves. Prepare the investor-grade paragraph that explains the next 6 months of lift.

How To Increase Business Valuation

Multiples rise when two things are true. First, the business produces cash predictably. Second, the path to more cash is visible and de-risked. This playbook makes both true in public view. That is how to increase business valuation without gambling on a one-time spike.